binance us taxes reddit

Different countries seem to have different experiences with this platform. Automatically sync your Binance US account with CoinLedger by entering your public wallet address.

Serious How Are You Dealing With Crypto Tax In 2020 2021 R Cryptocurrency

Indian government just announced that crypto will be taxed at 30 of gains.

. Alternatively Bancor offers impermanent loss protection at 1 per day on an opt-in basis once users have staked. Binance US Tax Reporting. Really hoping someone has a definitive answer.

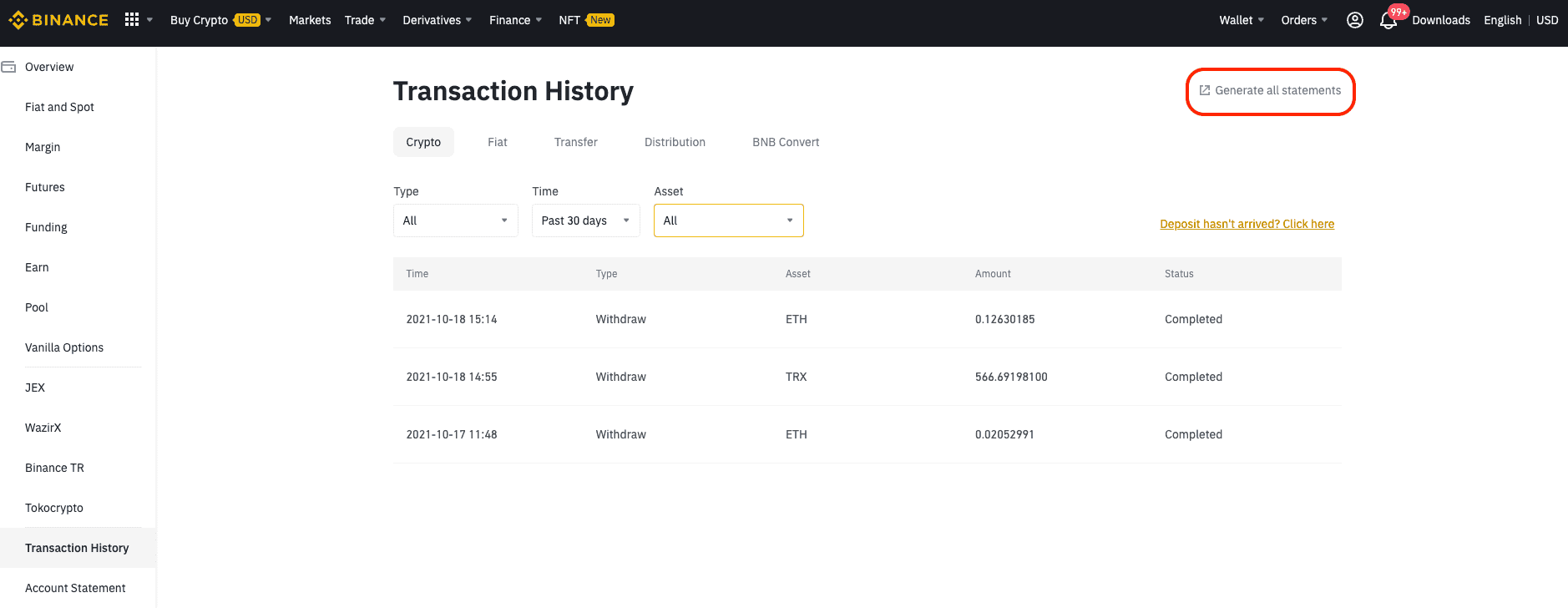

Previously BinanceUS took the position that it was a Third Party Settlement Organization TPSO under Section 6050W of the Internal Revenue Code and accordingly filed Forms 1099-K for certain transactions settled on the exchange. BNT is an ERC20 token that serves as the native asset of Bancor. BinanceUS makes it easy to review your transaction history.

Binance tax documents to know everything about Binance taxes and Binance tax reporting thatll help you stay on top of your taxes. BinanceUS is a fast and efficient marketplace providing access and trading for 90 digital assets. Sharing your Tax API Key and Secret Key.

We have integrated Binance via API on BearTax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes. Users can access the Tax Reporting Tool via Account API Management on both Binance Website and Binance App. BinanceUS does not currently support ERC20 and BEP20 TRX deposits and withdrawals.

I have this same question. There is no other way. We will continue evaluating coins tokens and trading pairs to offer on BinanceUS in accordance with our Digital Asset Risk Assessment Framework community feedback and market demand.

Top these all up with a. They create gains and loss reports for you. Especially when you are dealing in so many decimals of whole units and the fees are in a totally different currency from the actual trading pair.

Buying goods and services with crypto. Earlier this year Binance was banned in 7 states. The ownership of any investment decisions exclusively vests with.

It is used to purchase datatokens which are critical to the functionality of the Ocean Protocol marketplace. RECOMMENDED Disable trading access for this API key. Click the Edit button.

Business expenses will also not be allowed. Crypto to crypto in the US is a taxable event. Biconomy is a multi-chain relayer infrastructure designed to help users seamlessly access dApps or decentralized apps across different blockchains.

Create a new API key by entering a label such as CoinTracker and clicking the Create New Key button. By purchasing a particular data token on the Ocean marketplace users gain. BinanceUS is a fast and efficient marketplace providing access and trading for 85 digital assets.

Do not send ERC20 and BEP20 TRX tokens to your BinanceUS wallet. Transfer read-only user transaction history and records of capital gains and losses on Binance to third-party tax vendor tools. If you do this through an exchange you better count on the IRS finding out.

According to their website. There are a couple different ways to connect your account and import your data. Click here to add your BinanceUS Tax API Key and Secret Key to CoinTracker.

And oh be ready to get charged 30 if your account is dormant for 6 months. This goes for ALL gains and lossesregardless if they are material or not. No they stopped issuing 1099-K s from 2021 so they dont report to the IRS.

The tax will apply to all gains on digital virtual assets and no capital losses will be allowed. User Theinbredunicorn on Reddit said. Crypto back to USD yes.

Any assets that stay staked for 100 days or more will receive impermanent loss protection. I also for the past few weeks have been unable to get turbotax to accept my tax API key from BinanceUS. Capital losses may entitle you to a reduction in your tax bill.

We will continue evaluating coins tokens and trading. You need to have a maintaining balance of 3k or else risk getting charged 300 and it requires 5k daily balance to start earning interest of less than 1. BinanceUS does NOT provide investment legal or tax advice in any manner or form.

Bloomberg News reported that Binance was under investigation by the United States Department of Justice and Internal Revenue Service for money-laundering and tax evasion. Open the Binance API page. If you use Bitcoin to pay for any type of good or service this will be counted as a taxable event and will incur a liability.

I am not an accountant. I have tried deleting and creating new API keys several times and none of them go. Once you have your Tax API Keys complete the steps outlined below.

Still that would be a lot more transactions. You can generate your gains losses and income tax reports from your Binance US investing activity by connecting your account with CoinLedger. What I dont understand is why binance global prohibits US-based users I assume this is so binance can comply with US regulations yet certain crypto tax reporting tools require the user to specify if they have traded on binance global in order to generate an accurate tax report.

I am wondering if there is a limit to the number of tradestransactions that turbotax can accept and upload. Disable the Enable Trading permission. Binance US taxes best practices are to create an account with cointracketio and connect via the tax api on BinanceUS.

Thats like 3 different symbol for one trade. This is the first time the Indian government is discussing crypto taxation. Get a real-time overview of their local tax liabilities by integrating third-party tax.

Currently Cointracker doesnt support margin or futures reporting but it is in development. Use code BFCM25 for 25 off on your purchase. The Tax Reporting Tool allows users to.

If applicable enter your two-factor authentication code. For certain transactions in the United States a 1099-K must be submitted with the Internal Revenue Service. To connect your BinanceUS account to CoinTracker youll first need to Generate your Tax API Key on BinanceUS.

Imagine if Binance establishes partnership with us and has this capability in-built to send out tax forms directly to your email - that would be a great step towards. Users earn BNT in exchange for providing liquidity or staking on Bancor. As it stands right now crypto is an asset especially if youre using it to make profits.

Copy the API Key and Secret. Developers can use Biconomys Application Programming Interfaces APIs and Software Development Kits SDKs to simplify the Web3 experience and smooth pain points for users in the following. Valid from 1126 to 1130.

Log in to your CoinTracker account. The IRS states that US taxpayers are required to report gains and losses or income earned from crypto rewards based on certain thresholds on their annual tax return Form 1040. OCEAN is an ERC-20 payment token and functions as the Ocean Protocols native token and is used for community governance as well as for staking on data.

Freetaxusa Review Pros Cons And Who Should Use It

How To File Your U S Crypto Taxes R Cryptocurrency

How To Obtain Tax Reporting On Binance Australia Frequently Asked Questions Binance Support

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

Crypto Taxes In 2021 Tax Guide W Real Scenarios R Cryptocurrency

![]()

Using Turbotax Or Cointracker To Report On Cryptocurrency Coinbase Help

Germany Crypto Tax Guide 2022 Koinly

3 Steps To Calculate Binance Taxes 2022 Updated

The Complete Pancakeswap Taxes Guide Koinly

How To Obtain Tax Reporting On Binance Australia Frequently Asked Questions Binance Support

How To Prepare Your Crypto Taxes Bittrex Exchange

New Upgraded Tax Reporting Tool R Binanceus

I Ve Tried Crypto Tax Software So You Don T Have To R Cryptocurrency