nh food tax rate

A 9 tax is also assessed on motor vehicle rentals. Prepared Food is subject to special sales tax rates under New.

States With The Highest Lowest Tax Rates

Nh Food Tax Calculator.

. Food Service guidance issued on May 18 2020. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0.

Hebron has the lowest property tax rate in New Hampshire with a tax rate of 652 while Claremont has the highest property tax rate in New Hampshire with a tax rate of 4098. New Hampshire Sales Tax Rate 2021. Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85.

The New Hampshire sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the NH state tax. New hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. Legislation - RSA 165.

Review. Municipal reports prior to 2009 are available by request by calling the department at 603 230-5090. Tax Year.

Official NH DHHS COVID-19 Update 34b. The new tax rate has been set by the state - 1950 per thousand of your assessed value. The state meals and rooms tax is dropping from 9 to 85.

New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. Nh Food Tax Calculator. State of New Hampshire and the Towns of Hampton North Hampton Rye.

The state does tax income from interest and. Prepared Food is subject to special sales tax rates under New Hampshire law. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. The 2021 Equalization Ratio is 945. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

The state does tax income from interest and. Barrington Community Food Pantry. The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0.

All documents have been saved in Portable Document Format unless otherwise. Granite Staters grabbing a bite to eat or staying in a hotel beginning Friday will see a little bit of relief moving forward. Employers can view their current and prior.

Nh Food Tax Calculator. Exact tax amount may vary for different items. 45 rows Annual Tax Rate Determination Letters mailed by September 2 2022 for the tax period 712022 Q32022 through 6302023 Q22023.

The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0. For additional assistance please call the Department of Revenue Administration at 603. Total Tax Rate 2079.

The state does tax income from interest and.

Report School Funding Method Used Across N H Isn T Fair To Students Or Taxpayers

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

States Without Sales Tax Article

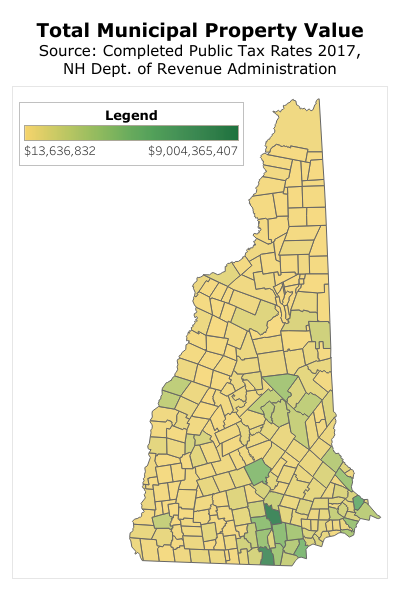

Measuring New Hampshire S Municipalities Economic Disparities And Fiscal Disparities New Hampshire Fiscal Policy Institute

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

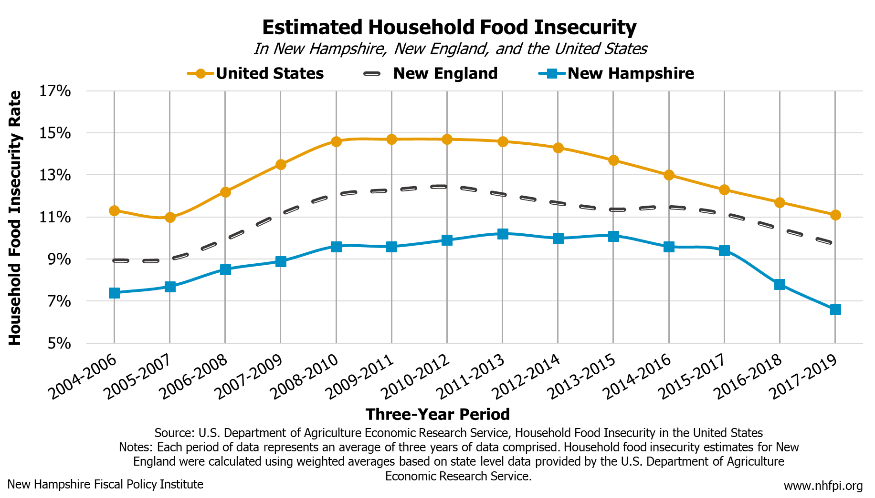

Food Insecurity And Economic Conditions In New Hampshire And The Nation New Hampshire Fiscal Policy Institute

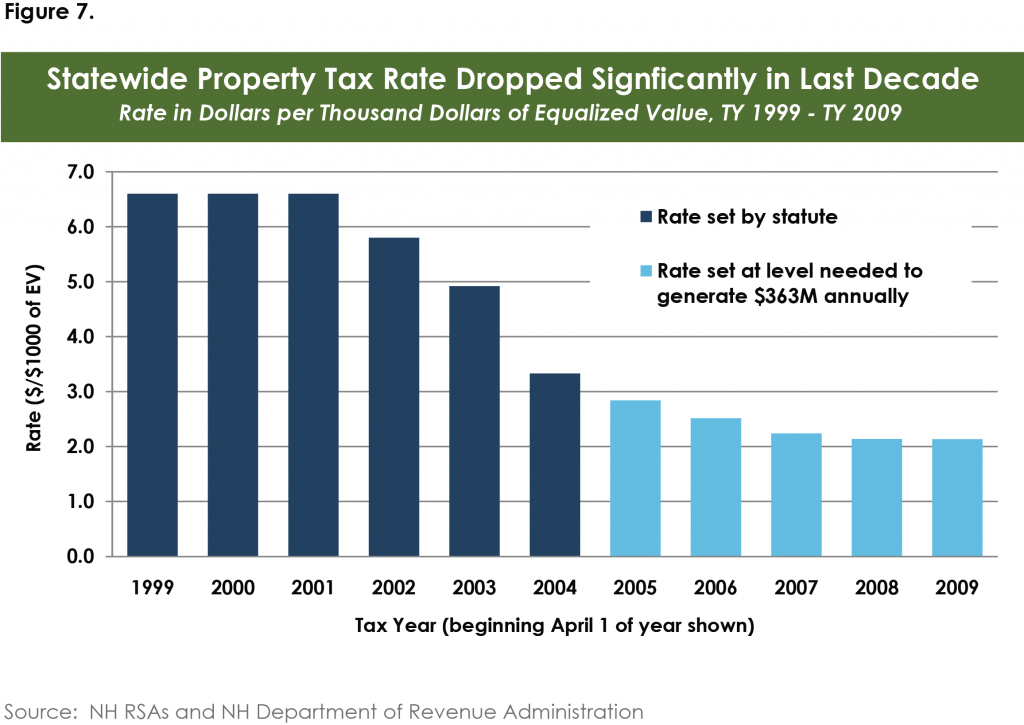

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Pdf Do Grocery Food Sales Taxes Cause Food Insecurity Semantic Scholar

Sb 193 Analysis Of Potential Impact On Tax Rates In Rural New Hampshire Reachinghighernh

New Hampshire Meals And Rooms Tax Rate Cut Begins

Tax Rates Ratios Town Of Nottingham Nh

You Asked We Answered Why Is New Hampshire So Against Having An Income Tax New Hampshire Public Radio

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

General Sales Taxes And Gross Receipts Taxes Urban Institute

Tax Policy In Virginia The Commonwealth Institute The Commonwealth Institute

States Without Sales Tax Article

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities